Archegos Wrong-Foots Regulators

Archegos also caught supervisors off-guard, with experts telling finews.asia there are significant gaps in prime broker regulation.

Archegos Capital has been a debacle for banks, including the major Swiss ones. Credit Suisse has lost $5 billion and UBS booked $774 million, with another $87 million expected in the second quarter.

Regulators also have to take some flak. How could it be that roughly a half dozen systemic relevant financial institutes lost up to $50 billion from one client they lent money to - for highly concentrated speculation in a few shares? How was it possible that they allowed up to 20 times leverage on collateral? And why didn't the alarm bells ring earlier, much earlier?

How did the positions of the involved investment banks rise from $3.8 billion to roughly $44.8 billion in one year? In just the eight shares that Archegos mostly speculated on?

Losses Way Above Expectations

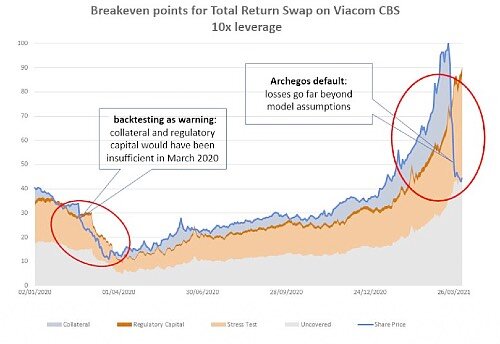

The risk management experts at Swiss-based consultancy Orbit36 have analyzed the case. And alarm bells should have been ringing at the banks and regulators in early 2020 (image below).

But the truth is that regulators were simply caught off the hook in March when the banks had to dispose the positions under stress, including the shares in Viacom CBS, that were used by Archegos as collateral for lending. The losses were way above the regulatory capital needed to offset the risks.

«The large losses of some banks in their derivatives transactions with hedge fund Archegos indicate serious shortcomings in regulatory capital regulation and stress testing methods for collateralized OTC derivatives», according to Orbit36.

(source: Orbit36)

Regulatory Boomerang

The financial crisis of 2008 shows how regulators react to unexpected surprises - with a regulatory boomerang. That has already happened in the case of Archegos. Financial regulator Finma has sent an assessor and opened an investigation. It also put limits on Credit Suisse's business, including the prime brokerage area, where everything happened.

In Switzerland's parliament, politicians are calling for the major banks to drastically cut their risk-taking. In the U.S., the Federal Reserve (Fed) is currently looking at the banks involved in the Archegos bankruptcy.

Going Over the Books

«You would expect that the various regulatory bodies to remediate the situation and strengthen banking regulation in that area,» Andreas Ita told finews.asia. The founder of Orbit36 used to be a bedrock of UBS. He was responsible for group capital allocation until June 2019, among other tasks, including the calculation of collateral margining in investment banking.

The main question now is what regulators will do. «From our point of view, it would be good to strengthen requirements around the calculation of risk-weighted assets (RWA) in prime brokerage.» At the same time, the recently revised and new Standard Approach for Credit Counterparty Risk SA-CCR has certain gaps, according to Ita.

Are Politicians Wrong?

Ita does not believe that increasing regulatory capital requirements will change much, as politicians are currently demanding «Regulatory capital in the Archegos case was never the problem, as Credit Suisse has additional capital of over 100 billion Swiss francs potentially available through bail-in bonds, and it can absorb the losses from that.»

The consequences for both Swiss banks, who were leaders in the prime brokerage space, could be significant.

«Tightening the calibration of risks could lead to such an increase in capital costs for prime brokerage that the business would no longer be profitable for some banks», Ita said.

When asked, Finma said that the Swiss capital regime in the brokerage business is based on internationally relevant BIS standards. In addition, Finma requires a buffer above and beyond that for the major banks. Regulators are always evaluating where their measures are effective or not and takes action on a regular basis if they see if they are not.

Wild West

According to news reports, Credit Suisse only made 16 million francs last year from Archegos, practically nothing in consideration of the risk it was taking. Archegos financed itself mostly through swaps, which are not highly regulated, and a business that some have compared to the wild west.

Using an outdated and obsolete system to calculate margin requirements, along with high rates of management fluctuation, apparently made Credit Suisse more vulnerable than others.

Stress tests, which regulators require banks to perform on a regular basis, are also up for debate. According to Orbit36, using the EBA EU-wide stress testing methodology should have captured the Archegos risk.

Banks Have a Say in Finma Stress Tests

In Switzerland, Finma conducts stress tests with the major banks every six months in which they look at all risks through a Loss Potential Analysis LPA framework. But these were ostensibly not enough to prevent an Archegos type scenario from happening. But the truth of the matter is that Finma provides the parameters and scenarios and UBS and Credit Suisse make the calculations themselves.

«It is possible that some lessons will be learned from that», Ita commented. Finma itself does not comment on individual stress tests.

Branch experts such as finews.asia editor Andrew Isbester says the problem lies in the front-line. The best RWA rules and stress tests are useless if the business itself doesn't fully own the risk and do something about it. It is therefore important that they also start directly bearing the consequences of these kinds of losses when they happen, right down to individual cost centers.