Japanese Power Broker's Face-Off for Swiss Re

Swiss banking power broker Walter Kielholz has faced down many a tricky situation in his long finance career. finews.asia explains why he may have met his match in Softbank's Masayoshi Son.

Ten years ago, Walter Kielholz stood at an abyss: the firm he had spent years building up, Swiss Re, posted a loss of 6 billion Swiss francs due to toxic investments. Bailout or collapse seemed to be the only two options for the world's largest reinsurer at the time.

What happened next is instructive for how Kielholz, an impeccably connected power broker, works: he secured support from legendary investor Warren Buffett, whose firm granted a 3 billion franc lifeline. Unsurprisingly, Kielholz replaced Peter Forstmoser as Chairman of Swiss Re the following year.

Sun Setting?

The 66-year-old has kept a low profile since 2009, when he stepped down as Chairman of Credit Suisse in favor of the top insurance job. Four years ago, he quietly left the Swiss bank's board altogether.

Observers have speculated recently that Kielholz (pictured below), a record-holder for the length of his board tenures, could step down at Swiss Re. Is the sun setting for the inconspicuous banker who has defined Switzerland's finance sector like no other in recent years?

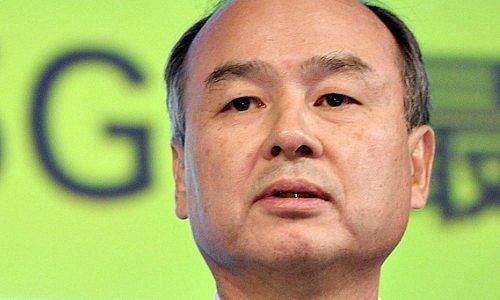

Probably not anytime soon, thanks to a high-stakes face-off with Japanese billionaire businessman Masayoshi Son (pictured on top), whose Softbank is circling Swiss Re. At stake? Son wants to control up to one-third of the Swiss reinsurer, as well as stock the board with several delegates.

An Invention A Day

Son has developed a reputation for getting what he wants – usually control. «Son's Softbank is the leader of the wolf pack,» Germany's «Handelsblatt» (in German) wrote of the 60-year-old's plans recently.

In fact, Son has never been happy in second place in his rags to riches career: the son of Korean immigrants in Japan, he studied at the University of California at Berkeley. «An invention per day,» was his maxim even then.

300 Years of Growth

Since founding Softbank in 1981, Son's ambitions have only grown more lofty: he wants the Japanese firm to grow for another 300 years at least, as a disruptive pioneer. He aims to build the conglomerate into the most important global firm in the new era of humans connected to machines – full stop.

And Softbank has the arsenal for the revolution since its «Softbank Vision Fund» tapped more than $90 billion, with which the conglomerate wants to step up the pace of its stake purchases and takeovers.

Son is known for an impatient, but personal approach, reportedly inviting counterparts to Softbank's Toyko headquarters to pepper them with questions about their firm's broader opportunities.

Tempting Booty

- Page 1 of 2

- Next >>