FTX Goes Kaboom! Leaving Star Investors Peering Down the Drain

Celebrities rallied around former crypto wunderkind Sam Bankman-Fried as the FTX exchange is imploding. The spectacular collapse of his crypto empire is hitting some of them hard.

The dramatic fall of the FTX exchange is dragging down one of the crypto world's most colorful players. Until recently, founder Sam Bankman-Fried's (SBF) fortune was an estimated $15.2 billion. But now, the crypto guru's star is tarnished and he disappeared from the «Bloomberg Billionaires Index.» His estimated personal wealth evaporated (paywall) by more than 90 percent in a very short time.

The FTX fiasco is also hitting some of the most prominent names in the financial world, with the scale of potential losses enormous. To begin the year, FTX was valued at $32.5 billion. In a financing round in the middle of last year, the company was celebrating what it billed as the largest capital increase in the history of crypto exchanges, having raised $900 million for more than 60 investors.

Investing Royalty

The list of investors reads like a «Who's Who» of the financial world. Tiger Global Management, Third Point, and Altimeter Capital Management were among the hedge funds that participated in the financing round. Other figureheads included venture capital company Sequoia Capital, the private equity company Thoma Bravo, and Masayoshi Son of Japan's Softbank, along with the family office of legendary hedge fund manager Paul Tudor Jones. In total FTX has raised $1.8 billion in seven rounds of funding, according to the online platform «Crunchbase.»

Bailing out of a Bailout

Instead of massive returns from a potential FTX public offering, these investors are instead threatened with heavy losses, if not total write-offs. The once high-flying crypto exchange FTX is on the brink of extinction after a planned bailout by industry rival Binance fell through and put regulators on notice.

Billion-Dollar Hole

On Wednesday, Binance founder Changpeng Zhao backed out of a takeover deal announced the day before. A deeper look into the crypto exchange's books must have scared him. The capital gap Bankman-Fried's convoluted empire is currently estimated to be $8 billion and includes crypto hedge fund Alameda Research, whose balance sheet consists largely of the comparatively illiquid FTX token FTT and Solana's SOL token.

As the price of the FTX-owned token plummeted, Alameda's financial situation worsened, which in turn affected the FTX exchange and led to a liquidity crisis, with customers withdrawing funds on a large scale. Alameda, as one of the largest bettors in the crypto hedge fund industry, had taken risky positions which have since turned into losses. Faced with a precarious financial situation, SBF could no longer tap investors willing to inject fresh capital.

Memories of Terra-Luna

Against this backdrop, the entire cryptocurrency market is reeling. Bitcoin & Co have again crashed hard, with losses reminiscent of the rapid slide in the spring, when the crypto ecosystem Terra-Luna collapsed, triggering an industry-wide crisis of confidence.

Given the interplay between the FTX exchange, Alameda, and the rest of the crypto ecosystem, analysts at JP Morgan fear a cascading of margin calls or at the very least demands for additional funding from those pledging their crypto assets against loans. Meanwhile, US regulators are investigating whether FTX properly handled customer funds and the company's relationship with Alameda.

Tom Brady is In. Are you?

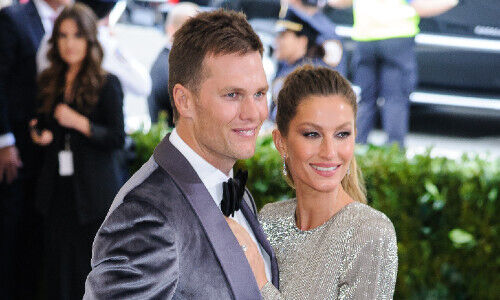

The glitterati of showbiz and sports are now looking down their respective drains. Seven-time Super Bowl winner Tom Brady and former supermodel Gisele Bundchen, recently separated, are among the likely losers in the crypto exchange's stunning collapse.

In 2021 the former power couple acquired shares in FTX. Brady was a brand ambassador and appeared in commercials for the crypto exchange, and Bundchen was named an advisor on environmental and social initiatives for the company.

They are not the only personalities in the sports world who could be affected by an FTX bankruptcy. FTX is a major sponsor of Major League Baseball and holds the naming rights to the Miami Heat's arena. Basketball legend Stephen Curry and baseball star Shohei Ohtani also have public partnerships with FTX.

Joining FTX's list of sports ambassadors in March was tennis star Naomi Osaka. The four-time Grand Slam winner signed a long-term partnership with FTX aimed, among other things, at attracting women to the crypto platform. For her promotion, the Japanese tennis player received both company shares and an undisclosed amount of cryptocurrency.