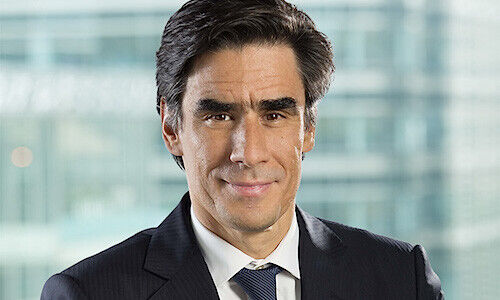

Nuno Matos: «No Doubt» Clients Will Increasingly Take Ownership of Data

HSBC’s wealth and personal banking chief Nuno Matos underlined the importance of securing client trust rather than developing technology as the top factor to success in future banking.

«We love customers and we love technology, in this order,» said HSBC’s Nuno Matos during a panel at this week’s Singapore Fintech Festival.

According to Matos, there is limited technology that can be applied if there is little to no access to data – an asset that he believes will increasingly come under ownership of customers.

«I have no doubt that more and more, the information will be owned by the customer,» he said. «And I have no doubts that more and more competing powers will be at the extremities of the matter. The question is who is going to earn the trust of those customers so they share with you their data?»

Earning Trust

«[Incumbent banks] have been in this business for centuries and we learn that the most important value in financial industry is trust,» Matos explained, underlining the long track record as a factor of future success in the panel which also featured the president of Tencent's fintech unit Forest Lin.

«And that’s something that you need to learn from a very young age if you don’t want to make mistakes.»

Matos shared an example where such trust had been earned through a wearable created by HSBC which allowed the bank to access physical data from clients to not only underwrite their condition and allow cheaper insurance coverage but also incentivize healthier lifestyles.

Tech-Driven Engagement

The bank is already reaping the returns of its tech investments, especially through increasing interactions with clients.

Leveraging its big data capabilities, HSBC’s Hong Kong unit offered 20,000 different combinations of portfolio rebalancing which led to a 10-fold increase in conversations between clients and relationship managers.

2,000 customers per week dialogue with the bank’s virtual assistant for wealth management which is powered by artificial intelligence and natural language processing.

Hybrid Model

But despite the growing technological advancements, Matos, much like many of his industry peers, insists that people remain key in the business and that the «hybrid model» remains optimal.

«When it’s just technology, I think it’s a weaker proposition than the combination of good advice powered by technology,» he said.

- finews.asia is an official media partner of the Singapore Fintech Festival 2021