Hiring Pays For Julius Baer in Asia

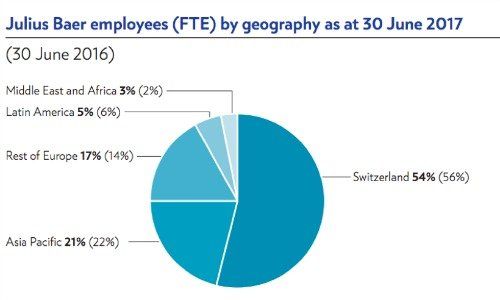

Profits edged lower for Julius Baer as spending, including for new recruits, particularly in Asia, rose. In its first-half report, the Swiss private bank also gave an overview of its Asian business.

Despite a slowdown in economic expansion as Asian economies mature, the pure play private bank expects Asia to continue to lead the world in new wealth creation over the coming decade, it said in its half-year report.

Julius Baer believes through its Asian network it can take advantage of the region’s continued growth in investable assets.

The bank claims it is benefitting from last year’s expansion of experienced relationship managers, saying it achieved «very strong» net new money inflows.

The Zurich-headquartered serves the region from a number of locations, including Singapore, Hong Kong and India, making Asia its second home market.

However it is currently focusing on five key markets to achieve organic growth: mainland China, Hong Kong, Indonesia, Singapore and India.

Still Hiring But Selectively

Julius Baer has also seen progress in its recently established subregion emerging Asia, particularly in the Philippines and Thailand – markets other Swiss wealth managers have been targeting.

And although the bank continues to invest in experienced private bankers, the hiring efforts have become more selective, accompanied by strict management of low performers.

Progress in Japan

Via its branch in Japan, the bank saw business develop in the first half of the year with «healthy net new money inflows,» further supported by successful cooperation with local partner banks.

The Swiss bank is now one of the largest and well established foreign wealth managers in India, covering the domestic market from the five major cities of Mumbai, New Delhi, Kolkata, Chennai and Bangalore.

Non-Resident Indian Moves

Julius Baer has also been active in the non-resident Indian sector from different locations in Asia, the Middle East and Europe. The bank added headcount and selectively broadened its private banker headcount in Dubai, Zurich and Singapore and established a dedicated desk in Hong Kong.

But in a recent blow to its Indian unit, Atul Singh, who ran the business for nearly two years, decided to take on a new challenge outside the bank.