UBS Shareholder GIC Voices Rare Rebuke

Singapore's sovereign wealth fund GIC is UBS' largest shareholder, amassing a 6.4 percent stake in the Swiss bank during the financial crisis. The discreet fund's head has some stern words over recent scandals.

Disclaimer: According to the board of the stars foundation this article makes a number of conjectures and allegations that have nothing to do with the presentations made by Siong Guan Lim. Read more

Singapore's Government Investment Corporation (GIC) manages the city-state's more than $100 billion in financial reserves. It became UBS' largest shareholder in a series of cash injections in 2007 and 2008, before the Swiss government finally stepped in with a rescue package.

The GIC has always been quiet about its intentions for UBS, and remained silent as the bank struggled through a series of costly and painful scandals including one over U.S. tax evasion, rigging benchmark interest rates, and colluding over foreign exchange and precious metals trading.

If the GIC has wielded influence over the bank's strategy, it has done so with its trademark absolute discretion.

«Pulled Up» for Wrong-Doing

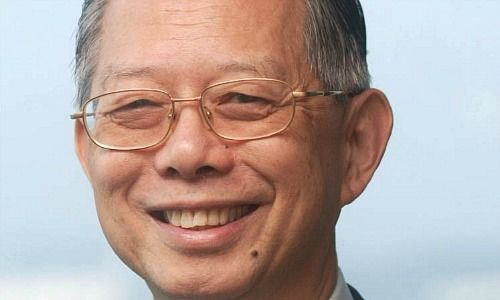

Siong Guan Lim, who has been president of the GIC since 2007, made clear how displeased he was over repeated scandals in the financial industry at «stars», a leadership symposium held by an independent foundation in Stein am Rhein, Switzerland.

«It is quite remarkable that after the global financial crisis, several people got pulled up on Wall Street. Every one who got pulled up said they hadn’t done anything wrong – every one.»

Dangerous «Settlerism»

He coined the term «settlerism» to downplay financial crime emblematic of the post-crisis scandals: «It is a settlerism that says it’s OK to cheat as long as you're not the worst cheat, it's OK to lie as long as long as you’re not the worst liar.»

Never referring to UBS by name, Lim recalled how he met a senior executive of one of the banks at the center of the Libor scandal as the investigation widened.

«I said, 'how does it come to be that your bank was one of these?' And he said, 'actually we're not that bad, the information we gave was closer to the truth than the other guys'. That's relatively settlerism,» Lim said.

«If You Do Wrong, Be First»

UBS enjoyed a conditional immunity from U.S. prosecutors in the Libor probe in return for providing details of a rate-rigging ring linked to Tom Hayes, a former trader at the Swiss bank now fighting his jail sentence.

Lim described how bankers in general showed a lack of awareness of wrong-doing during the crisis – save for a former Vatican butler who admitted stealing sensitive documents linked to the Pope.

Lawyers and compliance experts – and not standards of «good and right» – increasingly dictate corporate policy, complained Lim, who is the co-author of two books on leadership and competitiveness.

«The law is always going to be late. Therefore if you are going to do wrong, be the first one, because when you’re the first one, the lawyer is not yet there to catch you yet,» he said.

UBS and 1MDB

«Even though we may get away with it from time to time, if we are concerned about being sustainably successful, then you have to build up your trustworthiness, then you have to build up and be clear with your ideas about seeking to do good and seeking to do right,» Lim said.

UBS is among the banks to be «pulled up,» in Lim's parlance, by Singapore's financial regulator over its dealings with alleged corruption linked to 1MDB, a state fund in Malaysia which is at the center of a bilion-dollar graft scandal.

Lim didn't address 1MDB or Singapore's role in the money-laundering scandal, which has since ensnared other banks. It represents the city-state's first real test of how its financial center handles illicit funds.