The one-two punch of massive client outflows and the loss of confidence in the global financial industry proved too much for Credit Suisse to overcome.

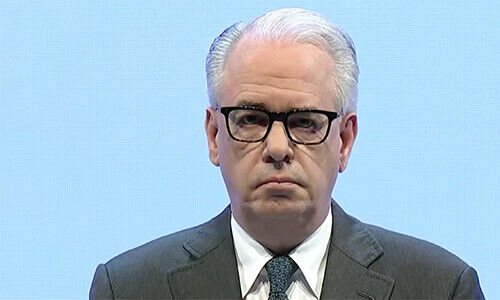

Addressing what is the last annual general meeting (AGM) of Credit Suisse, Group CEO Ulrich Koerner said the 167-year-old Swiss institution's forced takeover by UBS «fills me with sorrow. What has happened over the past few weeks will continue to affect me personally and many others for a long time to come.»

Koerner, who had a reputation for cost-cutting, was brought back to Credit Suisse in 2021, becoming CEO in August of last year. He was charged with implementing a new strategy for an institution marked by years of scandal and mismanagement.

A New Credit Suisse

The plan was to build a «new Credit Suisse» focused on wealth management and Swiss banking, along with a radical restructuring of its loss-making investment bank.

«Unfortunately, we didn’t succeed. We ran out of time,» he said.

A Double Whammy

Clients were pulling their funds out of Credit Suisse, and this accelerated in early October of last year because of «unfounded rumors and speculation,» Koerner said. For legal and compliance reasons, Credit Suisse could not address those claims.

As a result, «our hands were tied for almost four weeks until the new strategy was communicated on October 27, 2022. Only then were we able to address these incorrect statements,» he said.

Still, he said the situation stabilized to a degree at the beginning of this year, even in a challenging geopolitical and macroeconomic environment. «But despite all our efforts, we could no longer reverse the loss of trust,» he said.

Then came the collapse of Silicon Valley Bank and Signature Bank in the United States, both coming at a time when Credit Suisse was «particularly vulnerable.»

No Choice Left

«While were able to turn the situation around at the end of 2022, we were unable to repeat this achievement. This is a matter of deep personal regret to me,» Koerner said.

Those two developments ultimately led to the bank's survival being at stake, and so Credit Suisse was forced to act quickly and decisively.

«We no longer had a choice. The collapse of Credit Suisse would have been catastrophic not just for Switzerland but for the global economy,» and in the end, the merger with UBS was the only feasible option, Koerner said.

And so the 167-year-old institution founded by Alfred Escher as the Schweizerische Kreditanstanlt in 1856 that is the forerunner of Credit Suisse closes another chapter in its history.