Wef Report: Banks Should Fear Heft of Big Tech, Not Fintech

Banks and insurers should be fearful of the growing influence of tech giants such as Amazon and Facebook, according to a new report from the World Economic Forum.

Fintech start-ups have fallen short of their ambitions to upend the competitive landscape in finance to date, the World Economic Forum (Wef) maintains. Financial technology firms have been charging ahead with innovation and inspiring others, but have failed to capture significant market share.

Instead, Wef experts believe that the real predators to traditional banks are global tech giants such as Amazon and Facebook, which will be bigger disrupters for banks than fintech start-ups, who have mostly failed to achieve scale.

Sharing = Losing

Its latest report suggests that the combination of «open data» regimes will weaken banks' control over data by allowing customers to share it with third parties. Data being moved into the financial cloud via the likes of Amazon Web Services will drive banking competition in the coming decade, Wef argues.

In Asia and increasingly beyond, Chinese tech giant Tencent's Webank platform, which allows retail customers to purchase products from multiple competing credit and asset management providers, is a template for the distribution of financial services in the future.

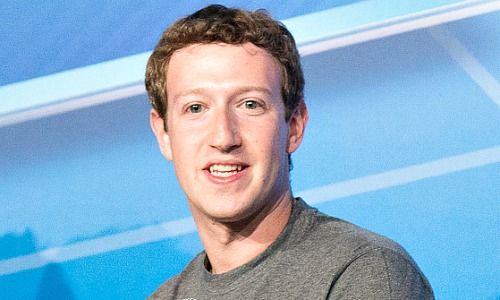

Facebook Threat

Jack Ma's Alibaba stable of firms is increasingly gaining market share around the globe. In the absence of a mature payments system, the Alipay mobile payment app now owns over 50 percent of the $5.5 trillion Chinese mobile payments sector, with tech giant Tencent as its only real competitor.

The possibility of Marc Zuckerberg's Facebook offering simple financial services products, backed by some partnerships, is also flagged in the report as a possibility.

And then there is another tech company by the name of Apple that could not only eat the banks lunch but their breakfasts and dinner too.