Name Screening Tools Under The Microscope

What happens when a Swiss private bank takes a hard look at its name screening tools? The results were a wake-up call, revealing surprising hidden gaps, unlocking practical improvements that delivered immediate, meaningful compliance impact.

By Daniel Nilsson, Senior Manager, and Andreas Kropf, Partner at Finalix

When ‘Close Enough’ Isn’t Good Enough

In 2024, Starling Bank was fined £28.91 million by the UK’s Financial Conduct Authority (FCA), and this was all because its name screening tool was misconfigured. It checked only a fraction of the required watchlists, allowing at least one sanctioned individual to slip through and operate an account undetected. The FCA called the controls 'shockingly lax,' and Starling isn’t alone.

The Pressure Is Mounting

Regulators are raising the bar. The Monetary Authority of Singapore (MAS) requires periodic independent validation of screening tools 2 and in Switzerland, FINMA expects formal oversight of material systems.

Source:finalix

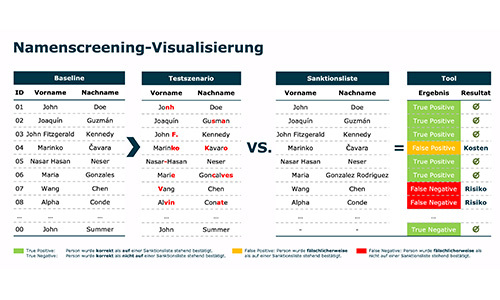

At the same time, banks are sounding internal alarms, citing growing false positives (where a person has mistakenly been confirmed to be on a sanctions list), analyst fatigue, and a fundamental uncertainty: «Is our screening system still doing what it's supposed to do» The risks are twofold:

- False negatives that expose the bank to sanctions breaches,

- False positives that overwhelm compliance and front teams with noise

One Bank, Two Tools, One Big Question

To find out, Finalix partnered with a Swiss private bank to assess two industry-established name screening tools – one for onboarding and real-time checks, another for periodic reviews and overnight batch screening.

Both were reputable and functioning, but neither was fully optimised. We went a step further, benchmarking the tools against each other and comparing results with a third tool not yet in use. We also leveraged our own internally developed name screening testing engine.

Our Approach: Structured, Scenario-Based, Real

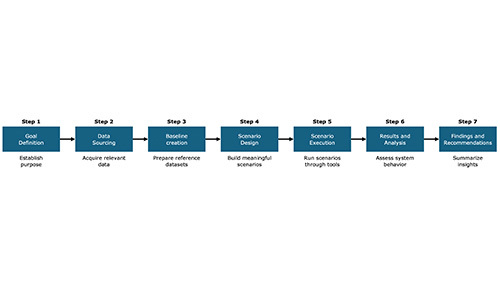

We applied a 7-step methodology, starting with a clear test objective.

Finalix Name Screening Validation Methodology:

Source:finalix

Using names from various sanction lists, we built a comprehensive library of true positives and designed 20 comprehensive test scenarios — ranging from basic to complex, with and without additional identifiers like date of birth and nationality. This allowed us to simulate real-world conditions and evaluate:

- Matching accuracy

- Resilience to data variation

- Operational impact

What We Found: The Devil’s in the Detail

We found that one tool was overly aggressive, flooding analysts with alerts, while the other was too conservatively configured, missing clear hits due to mismatched secondary identifiers.

In one case, a known sanctioned individual was not flagged because their date of birth didn’t match exactly, despite a strong name match. A dangerous blind spot. We recommended specific tuning for both systems, aligning detection thresholds to the bank’s risk appetite. The result was sharper detection, fewer false alerts, and stronger control.

Beyond Sanctions: Adverse Media and Data Privacy

When it comes to adverse media screening, the stakes are even higher. One news article can trigger a flood of alerts. Without fine-tuned parameters, compliance teams drown in noise. Meanwhile, with rising client awareness of data privacy laws - like GDPR in Europe or PDPA in Singapore - internal blacklists must be handled with care. Poor governance can trigger regulatory scrutiny, reputational fallout, or even legal action. Institutions must ensure transparency, fairness, and control.

There’s No One-Size-Fits-All

Effective name screening is not plug-and-play. Every bank has a different risk tolerance, customer profile, and operational setup. That’s why our approach is tailored - whether you’re testing for client onboarding, periodic reviews, payments and fund transfers, or correspondent banking. We adapt to the real-world pressures compliance teams face - and deliver insight that goes beyond the box-ticking.

AI Is Entering the Picture – With Mixed Results

We’re seeing more and more tool providers integrate AI into their screening solutions. While promising, this comes with its own risks, including poor data quality, more false positives, black-box decisions, integration headaches, and unclear regulatory expectations. AI can help, but only if it’s implemented with strong governance and human oversight. And it is important to remember: the ultimate responsibility still lies with the bank, not the tool, not the algorithm.

Why It Matters

Missed matches can cost millions in fines – or worse. Over-sensitive systems waste resources and erode confidence, and testing isn’t a formality but your first line of defence. Fewer false alerts not only reduce compliance and first-line overhead costs, but also free up teams to focus on higher-value, more relevant tasks.

Don’t Wait for a Wake-Up Call

If your name screening tools haven’t been tested recently – or ever – now’s the time.

Finalix brings the deep expertise, a proven testing methodology and advanced benchmarking tools to help you:

- Validate performance

- Reduce false positives

- Close dangerous gaps

- Build regulatory confidence

From diagnostics to fine-tuning- we deliver impact where it matters most.

Andreas Kropf, studied Information Management at the University of St. Gallen (HSG) and has extensive experience in consulting and line management across financial services, exchanges, structured products, and regulations such as MiFID II, FIDLEG, and Sustainable Finance/ESG. He began his career at Accenture in 1997, later working at Julius Baer and PwC, before becoming CEO of Derivative Partners Research in 2008. Following a year in executive search, he joined finalix in 2016.

Daniel Nilsson is a Certified Anti-Money Laundering Specialist (ACAMS) with nearly 20 years’ experience in consulting and financial services. Based in Singapore since 2011, he holds a Master of Laws and a Bachelor of Science in Business & Economics from Lund University, Sweden.

1 FCA fines Starling Bank for failings in its financial crime systems and controls

2 Strengthening AML/CFT Name Screening Practices