The names of candidates slated as replacements for CEO Philipp Rickenbacher are starting to materialize. Surprisingly, the bank seems to have a broad and deep selection of highly competent experienced suitors who can help get the bank back on track.

The search to find someone to take Philipp Rickenbacher's place at the top of Swiss-based international private bank Julius Baer has kicked into high gear, various sources in Zurich's financial hub indicate.

In truth, Rickenbacker was in a position to resign in December as CEO given the fact that it was in November when the private bank disclosed its problematic structured private credit of 606 million francs to a «European conglomerate», widely considered to be the now collapsed Signa group founded by Austrian investor René Benko.

Compensation Issues

At the time, the scale of the debacle was known and it wasn't seen as very feasible for the bank, under Rickenbacher, to claim it had turned over a leaf and was ready for a new start.

Ostensibly, it seems that Rickenbacher refused to resign at the time so as not to lose any of the deferred elements of his incentive-based compensation, certain sources in Zurich's financial circles maintain. That is because if he was let go or fired, he would likely lose at least a portion of that money.

Egon Zehnder Mandate

Whatever the case was, Rickenbacker stayed until the bank made it clear he had to go just before the publishing of 2023 annual results, something that finews.com reported on at the time. That step ensured that the departing CEO received all the deferred compensation coming to him. Since then, however, there has been a certain stigma in the air surrounding Rickenbacher related to Signa given he was seen, very mildly put, not to have left a particularly good impression in connection with it.

In the middle of all this, the bank had to start looking for a replacement, with the effort being led by chairman Romeo Lacher. To that effect, he scoped out at least three executive search companies, eventually choosing market leader Egon Zehnder. The decision was made, «because you can't go wrong with that», certain internal voices at the bank ostensibly believe.

The result from that effort seems to be a short list with a good half dozen names. Julius Baer itself refused to comment after being asked about the matter by finews.com.

The Credit Suisse Concentration Risk

Something that seems to be interesting when looking at the names is the fact that three former Credit Suisse executives, frequently named as prime candidates – André Helfenstein, Francesco De Ferrari, and Claudio de Sanctis – are not at the top of the list.

As research seems to indicate, the nomination and compensation committee thought that a CEO coming from the now-collapsed bank could be damaging to its image. Besides, Lacher spent a good 26 years at what was once Switzerland's second-largest bank, and having an inordinate concentration of former Credit Suisse employees at the top might also potentially sow internal doubt.

The profile for the institution's next leader has been unmistakably set in stone. Any candidate has to have CEO experience at a large financial institution with at least 7,500 employees, a deep know-how of the core business of wealth management, an understanding of the complexities of the Swiss and European market, and extensive knowledge of Asia, the bank's second home market.

Smart and Relaxed - but Still Controversial

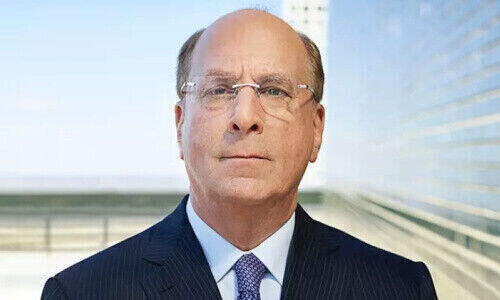

Former UBS CEO Ralph Hamers (Image: Keystone)

Nevertheless, there ostensibly is still a relatively large pool of candidates despite the strict requirements, so much so that it was not necessary to put the aforementioned Credit Suisse bankers at the top of the shortlist. A very interesting name that is currently being bandied about is apparently Ralph Hamers. The intelligent and relaxed Dutchman who surprisingly took the helm of Switzerland's largest bank, UBS, in 2020, was then seen as a controversial choice at the time for many different reasons. At the same time, no one can claim he made any large mistakes during his term, which ended in early 2023.

One of his largest achievements was accelerating the digitalization of Switzerland's largest bank and modernizing its entrepreneurial culture, something that makes sense in an extremely striated banking group like UBS. The bank's performance also stood in his favor and he launched the digital Key4 offering during his time there, something that has borne clear fruit in the domestic market in the meantime, as finews.com previously reported.

No Background Noise

Hamers only handicap was that UBS chairman Colm Kelleher wanted another CEO, something that he got in the end - with Sergio Ermotti. Another thing that continues to stalk him is that he stands accused of allowing a lax anti-money laundering control framework to fester while CEO of Netherlands-based global bank ING, which was ultimately forced to pay a significant fine in 2018. The more the current legal process related to that issue against management lasts, the higher chances are that it will be dropped, something that the Dutch media are speculating on may happen.

Something that speaks for Hamer is that he would fit in well with the Swiss and international elements of Julius Baer, which sorely needs a fresh start, one without any interfering background nose and a good deal of integrity behind it.

Curious Situation

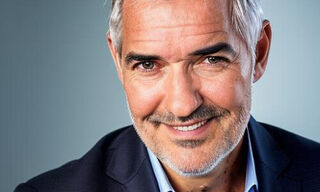

CEO of EFG International Giorgio Pradelli (Image: EFG)

The only thing that could stop Hamer is potentially his limited experience of the Asia Pacific region, a growth market that is critical for Julius Baer. But finews.com research shows there is another top candidate who fulfills that requirement in spades: Giorgio Pradelli.

The CEO of Swiss private bank EFG International, which rather curiously is often seen as a takeover target for Julius Baer, would have the necessary Asia experience. The institution has a very successful franchise in both Hong Kong and Singapore and it acquired additional regional heft by buying Ticino-based BSI in 2017.

Turning Point

The Torinese is at an inflection point in his career. Since being appointed to his current position, he has successfully managed EFG to become one of the most successful, listed private banks in Switzerland. In 2022 alone, he managed to increase its share price by 60 percent.

EFG International has also been profiting from the confusion and turbulence related to Credit Suisse, hiring client advisors, and reaping the benefits in the way of net new money inflows. The bank's recent figures sparked fireworks in the market. For Pradelli himself, a change after almost seven years might not be a bad thing. Given that, we would also have to see if there are any renewed rumors about a possible merger between the two.

Little Known

CEO HSBC Global Private Banking Annabel Spring (Image: LI/HSBC)

The selection of potential candidates is not limited to Switzerland. Some candidates can't be directly approached given that headhunters have mandates with certain individual banks, which means they often look farther afield abroad, where they also stumble across several names with potential. One of them is Annabel Spring.

Although she is not so well known in domestic circles, the Australian would have the ideal attributes to make the shortlist for the top operational role at Julius Baer. Spring has been CEO of HSBC Global Private Banking since 2020, the international wealth management arm of the UK-China-based banking conglomerate.

Close Contact with Colm Kelleher

Before her current role, she spent nine years at the Commonwealth Bank of Australia, her last job being Group Executive in the wealth management division, reporting directly to the CEO. Spring also had several leadership positions at major Wall Street franchise Morgan Stanley, where she worked for 15 years. During her time there, she was the global head of firm strategy and execution for time, working with or directly reporting to current UBS chairman Kelleher.

Given her background in the wider Asia Pacific region as well as her current job at a bank that is closely linked to the region, it is clear she also brings the required know-how to the Swiss pure play when it comes to further growth.

More Money

It is not surprising that Spring is seen as one of the top candidates given her background. The search process is currently in high gear, according to internal sources, given that Julius Baer has targeted June 2024 as the date when it wants to announce its new CEO.

The bank also seems to want to create a more conducive financial framework with a vote at the next AGM on April 11. Apparently, shareholders will be asked to vote on raising the requisite compensation pool. According to the Swiss financial portal «tippinpoint», they will be asked to raise the total to 35 million francs from the 18 million on hand, something that is also indicated in the bank's AGM materials.