It is hardly surprising given the turbulent year that Credit Suisse experienced that half of the most-read stories written by finews.com were in some way about the bank. But one of them was about a diversity champion.

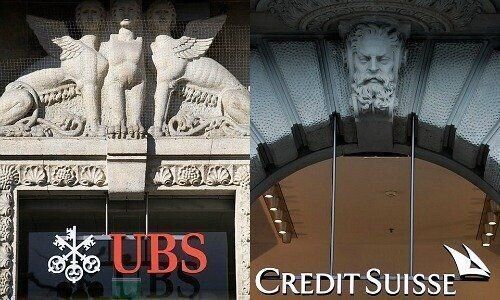

10. UBS Currently Sees Little Hope for Credit Suisse

Switzerland's two major banks are usually cautious about rating each other's shares. But right now, UBS sees little potential in its rival.

There was little to suggest that the stock will recover in the foreseeable future, especially after CEO Thomas Gottstein spoke of 2022 as a «transition year». Many bank analysts seem to be chimed in with the same view. The current share price vindicated their views.

9. Citi Nets JP Morgan Private Banker to Lead Family Office Unit

Citi has hired a private banking veteran with extensive experience in Asia to lead its global family office segment. Hannes Hofmann became the global head of the family office group, according to an internal memo seen by finews.asia.

8. Credit Suisse and the Silence of the Swiss

Credit Suisse is systemically important in Switzerland. Now, it is cutting thousands of jobs at home and allowing a bank backed by the Saudi regime to become a major shareholder. That «Switzerland Inc.», the federal government, and the authorities silently watch this development is something finews.com finds criminal.

Shortly after the news broke, a bon mot that the abbreviation «SKA» of the venerable Schweizerische Kreditanstalt (Swiss Credit Institute), the predecessor institution of Credit Suisse, now stands for «Saudische Kreditanstalt» (Saudi Credit Institute) quickly made the rounds.

7. Credit Suisse Has A Diversity Champion in Pippa Bunce

With her shiny blond hair, nails polished pink, and personality radiating pure vivaciousness, Pippa Bunce breaks like a ray of sunlight through the cloud that has been hanging over the Swiss bank.

«Expression is so important,» Pippa Bunce said, perfectly done up for an interview with finews.com. From the age of five, she didn’t want to stick to dressing only as a boy. «Luckily, my family was accepting, where home was a safe environment in which I could show who I was and how I felt,» she said.

6. UBS Raises Questions About Credit Suisse

Judging by the latest earnings figures, banks are operating more efficiently than they have in years. But the industry could soon be heading into rough terrain, not least Credit Suisse.

Banks in Europe are for the most part humming along nicely at a brisk pace and with relatively full tanks. This is evident from capital buffers, which, according to financial analysts at UBS, are more than sufficient to withstand an impending rise in borrowing costs. In an industry analysis, they point to government credit guarantees and fiscal interventions, which act as proverbial airbags.

5. Ex-Credit Suisse CEO Tidjane Thiam Switches Careers

Former Credit Suisse CEO Tidjane Thiam isn't suffering from a lack of work, having just landed another prestigious mandate.

Thiam who served as Credit Suisse CEO until February 2020, was elected to the board of directors of the French advertising and media group Publicis.

4. Is Liquidation the Only Option Left for Credit Suisse?

Following yet another setback in the first quarter of 2022, Credit Suisse’s options for moving forward appear to be dwindling.

«This bank should be liquidated!» exclaimed a finews.com reader on social media after Credit Suisse announced another quarterly loss on Wednesday. Bad news seems to be coming out with a numbing regularity at Switzerland’s second-largest bank.

3. The Next Big Swiss Banking Deal May Be Around the Corner

Boris Collardi took an $80 million stake in Swiss private bank EFG. He didn't do that just to keep the status quo. The consolidation underway in Swiss private banking is now decades old, and it is a saga that thrives on rumor and speculation - and the occasional acquisition and merger.

2. UBS Beset by Leadership Rumors

Resentment stirs at the group executive board over CEO Ralph Hamers' appointments while chairman Colm Kelleher keeps the pressure up.

UBS CEO Ralph Hamers is not having an easy time at the office. Both the scrapped takeover of US digital wealth manager Wealthfront and the group's persistently weak share price are putting enormous strain on him, as finews.com reported.

1. Credit Suisse Becomes Part of Saudi Crown Prince's Vision

In their need for capital, Credit Suisse leadership has indirectly come into contact with one of the world's most active sovereign wealth funds. The Saudi National Bank (SNB) is just one of the vehicles with which the petro state intends not only to diversify its economy but also to expand its international influence.