Former UBS investment banker Yassir Benjelloun-Touimi told finews.asia he wants to disrupt the art market with his startup Artex. It looks like he can count on high-profile support in doing so.

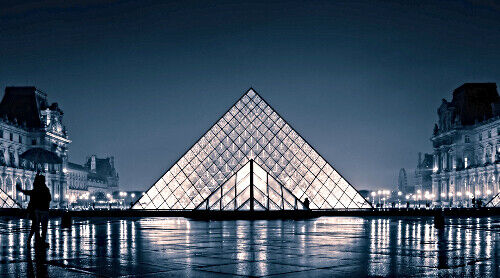

Yassir Benjelloun-Touimi (pictured below) likes to keep things exciting: «If I were to tell you now in which museum we will be presenting our first work of art, I would spoil the surprise for everyone,» the founder and CEO of Artex told finews.asia.

(Image: Artex)

However, he did give away that the event is taking place at the start of the year, and that additional works of art, from old masters to contemporaries could potentially be purchased.

Artex is aiming to disrupt the art market by making art ownership accessible to the masses, the former investment banker and hedge fund manager said.

Swiss Stock Exchange Onboard

Founded in 2020, the company aims to convert art worth millions into affordable shares, which are then traded centrally in the same way as traditional securities. The company, according to its own information, employs more than 60 people in Paris, London, Luxembourg and Liechtenstein, and is in negotiations with leading banks. It recently gained the Swiss stock exchange SIX, as a clearing partner for its art shares.

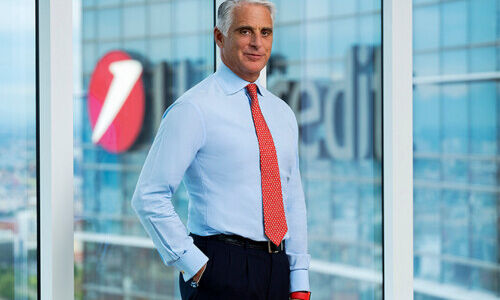

Benjelloun-Touimi's vision sounds richly ambitious but he has managed to convince Andrea Orcel (pictured below), former head of the UBS investment bank, and current CEO of Italian Unicredit.

Within the startup's organization, Orcel is earmarked as a possible future board member. «He grasped the potential of the idea of Artex,« Benjelloun-Touimi said referring to the Italian manager.«He realizes how profoundly we will change the world of art.»

Artex CEO and Orcel know each other from UBS, where Benjelloun-Touimi worked as an investment banker in a leading position in the trading of credit securities in Europe.

(Image: Unicredit)

In 2013, he turned his back on the Swiss institution to open his own hedge fund, Capital Partners. Arcade later merged into Dalton Strategic Partnership, an asset manager where Benjelloun-Touimi was a partner - together with the current president and co-founder of Artex, Prince Wenzeslaus of Liechtenstein (see picture below).

Board Princes

«Vince the Prince» (picture below), as he is called by the tabloids, is a big name in both the financial world and among the jet set. He is the son of Prince Philipp Erasmus of Liechtenstein, the current Honorary President of the Liechtenstein LGT Group - his father also sits on the board of Artex. Prince Wenceslaus once caused a stir when he dated top model Adriana Lima. As a former Goldman Sachs employee, he most likely also has a knack for figures.

The latter is also what Artex is all about. Art, an exclusive niche for millionaires, is to become an asset class accessible to millions of people, as Benjelloun-Touimi is hoping.

He is not only about doing business; every work of art securitized in shares is made accessible to the public - typically in a museum. Some of Artex's proceeds will be used for art training and to build a new «community» of art patrons, he said.

(Image: Dalton Strategic Partnership)

Inflation-Proof

The value of tradable art is estimated at $3.2 trillion worldwide and has increased significantly in recent years. Between 1999 and 2019, the Artprice 100 Index, a measure of the price of art, climbed an average of 8.4 percent a year. That's almost as good as the price of gold at 8.6 percent and significantly better than the US S&P 500 stock index at 6 percent.

Art also correlates little with the stock markets and has proven to be exceedingly inflation-proof over the past year.

«We have had a decade of monetary expansion, which is now fueling inflation in the long term,» Benjelloun-Touimi said. «Everything is getting more expensive, so we need to give people tools to protect their assets from this development.» For him, art, or Artex, is that tool. With securitization in shares and trading on the art exchange, works of art would go from being something exclusive and opaque to liquid and regulated assets.

From Hammer To Bell

His way to get there is old-fashioned. Quite the investment banker, he plans a separate company for each artwork, which will then be listed individually via IPO. «From the hammer to the bell» is how Benjelloun-Touimi sums up the process. At the start, each art share has a nominal value of $100.

Art shares are then traded via Artex; large banks connect directly to the platform to order the trades for their clients. Smaller private banks can use the big banks as corresponding partners.

It is notable that Benjelloun-Touimi has refrained from tokenizing the artworks. Such business models already exist for various real assets, not least in Switzerland. The issue of digital subscription rights to a work of art is significantly less complicated than a conventional IPO. Likewise, there are various advantages in post-trade and in safe-keeping.

Tokenization is Obscure

The Artex founder, however, is sticking to what he knows, in this case, shares: «Maybe our approach is simple. But I like simple,» he said.

Tokenization, on the other hand, is obscure, he said, using the repeated experience he has at crypto conferences: «People come up to me and ask: Am I the only one who hasn't understood what they're talking about up there?» Basically, crypto aficionados and he are after the same goal: to create value in order not to be at the mercy of stock exchanges and the paper money system.

Real Value

With art seen as an asset, doesn't the love of art fall by the wayside? For Benjelloun-Touimi, it is definitely the passion that counts: «I love art and art history,» the ex-investment banker said.