The ultra-wealthy look to be preparing for a market storm. From gold Christmas tree baubles to handy gemstones, the rich are finding inventive ways to escape the turmoil – as well as rising fees to keep cash at the ready.

It’s no fun having a Swiss wealth account these days, «Bloomberg» noted wryly this week. Why? The wealthy are finding no joy in financial markets: stock-picking requires strong nerves, traditional bond markets offer little to no yield and many investors don’t have the stomach for the contortions in emerging ones like Argentina and Turkey.

They are also reportedly buckling up for more market ructions by piling into cash levels last seen in 2012. The wealthy's cash piles represent a huge problem for private banks: they, in turn, get charged an increasingly high rate to park funds by the central bank.

Wealth Carrot-Stick

Wealth managers like UBS are trying to coax the rich out of their current hoarding mentality – which reflects the hope of at least not losing money. «In this environment, we generally recommend investing in quality and high yield investments in order to escape the ongoing negative interest rate environment,» Daniel Kalt, an economist with Switzerland’s largest bank, wrote in an investor note on Tuesday.

The only problem is that the rich aren't behaving, or doing what their wealth managers want. Kalt’s carrot is accompanied by a heavier stick by UBS: the Swiss bank and others have started charging fees on cash piles of 500,000 euros ($560,000). Inflation is eating into your cash anyway – even more so for the rich, according to Coutts.

The 327-year-old British private bank calculates inflation on the rich at 2.9 percent, based on measuring roughly 150 goods and services across 12 categories like housing, school fees, food, and alcohol. This outpaces the 2 percent rise in consumer prices in Britain.

Gold to Surge

What’s a rich person to do when the typical «flight» asset – Swiss francs – doesn’t work anymore? There’s always gold, where Bank of America Merrill Lynch predicts a surge to $2,000 an ounce, from the precious metal’s current six-year high.

The interest in alternatives to stocks and bonds has made way for a wider range of assets including private deals. But classic luxury purchases including fine art, collectible cars, vintage wine, and gemstones have also experienced a fillip.

Data bears this out: a luxury investment index compiled by Knight Frank climbed 9 percent last year, driven by surges in prices for rare spirits (a record for a bottle of Macallan helped), coins, wine, and fine art.

Macallan, Marie Antoinette, Hockney

Knight Frank, a property specialist, compiles the index based on data from Art Market, the Fancy Color Research, the Historic Automobile Group, Rare Whisky 101, and Wine Owners. Luxury buyers tend towards assets they feel an affinity for – they are seeking fun as much as a return.

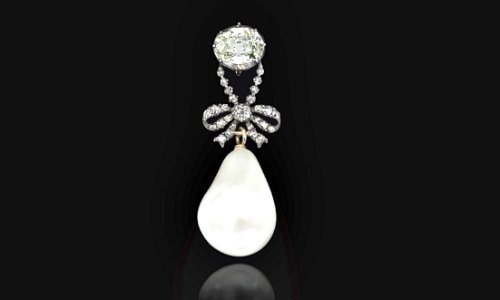

Sotheby's set a record for the priciest pearl ever auctioned when a diamond-and-pearl pendant once owned by Marie Antoinette (pictured below) went for $37.5 million in a bidding war nine months ago. Christie's sold the world’s most expensive bottle of whiskey for $1.5 million (a 60-year-old bottle of Macallan adorned with artwork by Valerio Adam).

(Image: Sotheby's)

And fine art, of course. There is the confusing tale of the Saudi Arabian crown prince and Leonardo da Vinci’s «Salvator Mundi», which fetched $450 million. Separately, a 1972 pool scene by David Hockney in November set the record for most expensive work by a living artist – $90 million – sold at auction.

Punishing Cash

The rich have always loved surround themselves with beautiful, exclusive, rare «objéts» – what is different now? The answer at least partly lies in a punishing regime on cash – another beloved asset class for the wealthy.

«Clients are becoming more interested in alternatives to cash in view of negative interest rates, and are also taking on a bit more risk,» according to Deloitte partner Ralph Wyss. «There is more interest in a wider horizon of tangible objects of value, especially fine art.»

To be sure, this isn’t new: the wealthy have fled towards cash since the financial crisis of 2008/09, and never really veered. The deepening of negative interest rates has simply accentuated the more than a ten-year trend, according to several wealth industry and luxury asset experts.

Trimming the Tree

A wealthy European family had gold Christmas tree ornaments manufactured: the pricey baubles are a good store of value, they are useful (once a year) and sturdy. Diamonds – tiny, easy to transport, even across national borders without detection – are another common caprice of the ultra-rich, according to experts.

Art houses have also seen an upswing, underpinned by the emergence of a swath of wealthy buyers from Asia and the Middle East. Possessing and displaying fine art lends social credence while also providing a smart place to stow money.

«Families of older wealth tend to combine the idea of art patronage with investing in something of value,» Deloitte’s Wyss said. «For newer money, it’s largely a straightforward investment with the hope of preserving or increasing wealth.»