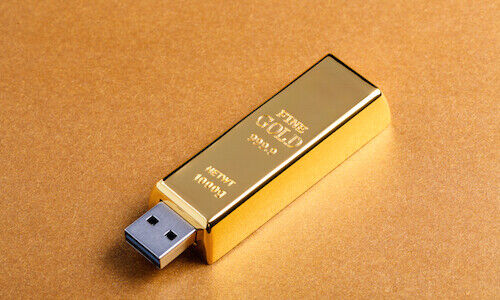

London-headquartered HSBC is actively exploring various opportunities to convert real-world assets into digital form. One such area is tokenized gold, which it will introduce tomorrow to its retail segment.

HSBC will be launching tokenized gold tomorrow to its retail clients, said Hong Kong chief digital officer Bojan Obradović during a panel at the «Milken Institute Global Investor’s Symposium». This will mark the first form of tokenized real-world asset that it is introducing to the segment.

Within this area, Obradović noted that the British lender was also exploring tokenization of other assets like funds or bonds. In addition, it is investing in distributed ledger technology (DLT) and developing capabilities in digital money such as central bank digital currencies, tokenized deposits and stablecoins.

Bitcoin Origins

According to Obradović, the genesis of DLT or blockchain technologies was the creation of bitcoin. He named three critical effects as a result including the formation of alternative money; the development of a digital asset that is unique and cannot be copied; and exposure to the power of blockchain networks that can store and transfer assets instantly with no underlying company behind.

«[Bitcoin is] considered one of the most prominent computer science innovations of recent times,» he commented on a panel at the event hosted by US think tank Milken Institute. «When we think about DLT or blockchain, we think that it has a strong potential to be a mainstream component of future financial markets.»