Dealing in contemporary art is big business – and UBS is very much part of it. The Swiss bank has now teamed up with a renowned art economist in a bid to advance its knowledge about the business.

The global trade in contemporary art is generating billions of dollars in business at auctions alone. The money made with works of art at galleries, by collectors or at exhibitions such as Art Basel is unknown – and the art business isn't exactly known for transparency.

Macro Art Trends

UBS plans to improve the economic knowledge available on the arts trade and has laid the foundations for an annual report called «Art Basel and UBS Global Art Market Report», with the first edition due in March 2017, coinciding with Art Basel in Hong Kong.

«The annual report will regularly cover all of the main macroeconomic art trends and deliver fundamental data on the art market as a whole,» UBS said in a statement today.

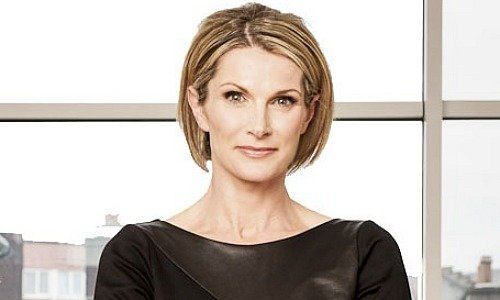

For the purpose, UBS has hired Clare McAndrew, an economist specialized in art, antiquities and collectors' items. She has been the author of a similar report for Tefaf, a rival exhibition to Art Basel.

Long-Standing Support for Art Basel

UBS wants to set a new standard and plans to continue its support of Art Basel into the next decade. The bank has been supporting the exhibition ever since 1994 and expanded its partnership to include Art Basel in Miami Beach in 2002 and Art Basel in Hong Kong in 2014.

Thanks to its 2000 acquisition of Paine Webber, which was a prominent collector of contemporary art, UBS holds one of the world's largest corporate art collections and also sponsors a series of exhibitions and museums across the world.

Important to Wealthy Clients

But art is also important to the bank as an investment vehicle and asset class for its wealthy clients. The UBS Art Competence Center provides expert know-how and independent advice on art-related matters to its customers.