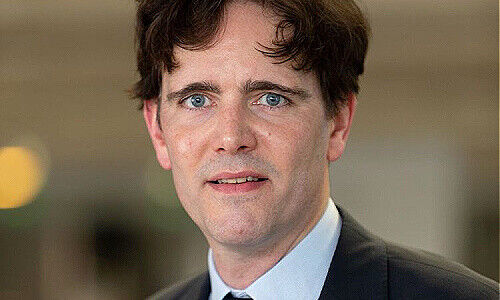

Jean-Baptiste Berthon: «Hedge Funds Dip Into Bitcoin»

While the bitcoin bull run in 2017 was largely driven by retail investors, the present surge appears to be driven by a wider set of investors, including institutional organizations, Jean-Baptiste Berthon writes in an essay on finews.first. Why is that?

This article is published on finews.first, a forum for authors specialized in economic and financial topics.

In addition to retail investors, family offices and high-net-worth investors remain dominant investors and sources of new bitcoin wallets and IP addresses. Bitcoin benefitted from a supportive backdrop, increasingly used as a hedge against falling real yields and massive central banks QE, which are feared to ultimately debase world currencies and boost inflation.

It is also an alternative to the declining equity dividend yield. Unsurprisingly, bitcoin’s correlation with gold and inflation, and to some extent equities, has become reasonably stable. Hedge funds have become significant bitcoin players, through dedicated investment vehicles, or through bitcoin additions to their allocations. While still in its youth, the market continues to gain depth, both in types of investors and product range.

«Several key risks warrant persisting high volatility»

In the early days, managers mainly focused on long outright positions on crypto assets, including Bitcoin, Ethereum, or Ripple. Since then, a broader range of digital assets-linked products allows managers to implement more flexible and sophisticated strategies. Managers can now use swaps, futures and options indexed on cryptocurrencies, they can also focus on income generated by the underlying technology. Moreover, they may invest in securities issued by companies involved in crypto-assets and their infrastructures –though most of these remain only accessible through venture capital and private equity strategies.

Hedge fund styles include discretionary and quantitative approaches. As the market gains depth, attracts new experienced investors and has an improving information flow, the alpha potential will likely moderate over the coming months and years. Yet, the market remains highly inefficient, and significant digital asset price dispersion provides room for arbitrage. Several key risks warrant persisting high volatility. Tighter regulation remains a structural risk (early regulation mainly focused on preventing fraud and misrepresentation, broader ranges of violations and risks will gradually be considered).

«Valuation indicators keep on flashing red»

Speculation risk is another obvious risk, amplified by leverage and systematic trading. Moreover, the absence of central authority to step in in times of crisis leaves investors without a backstop. Risks also come from the complexity of crypto technologies and the surging supply of digital assets, though this nearly $1tn market remains dominated by two providers. The recent bull run was cut short by a -20 percent drop.

Valuation indicators keep on flashing red (in particular our macro and market relative models). A normalization in momentum forces could also keep selling pressures. Yet, liquidity metrics have not deteriorated in an exaggerated manner thus far. We expect the latest cold shower to moderate institutional investors’ enthusiasm in the short-term, providing time to prepare for a third run later, and supported by tools better suited for institutional investors (including initiatives from central banks and commercial banks to offer more robust digital asset exposure)

Previous contributions: Rudi Bogni, Peter Kurer, Rolf Banz, Dieter Ruloff, Werner Vogt, Walter Wittmann, Alfred Mettler, Robert Holzach, Craig Murray, David Zollinger, Arthur Bolliger, Beat Kappeler, Chris Rowe, Stefan Gerlach, Marc Lussy, Nuno Fernandes, Richard Egger, Maurice Pedergnana, Marco Bargel, Steve Hanke, Urs Schoettli, Ursula Finsterwald, Stefan Kreuzkamp, Oliver Bussmann, Michael Benz, Albert Steck, Martin Dahinden, Thomas Fedier, Alfred Mettler, Brigitte Strebel, Mirjam Staub-Bisang, Nicolas Roth, Thorsten Polleit, Kim Iskyan, Stephen Dover, Denise Kenyon-Rouvinez, Christian Dreyer, Kinan Khadam-Al-Jame, Robert Hemmi, Anton Affentranger, Yves Mirabaud, Katharina Bart, Frédéric Papp, Hans-Martin Kraus, Gerard Guerdat, Mario Bassi, Stephen Thariyan, Dan Steinbock, Rino Borini, Bert Flossbach, Michael Hasenstab, Guido Schilling, Werner E. Rutsch, Dorte Bech Vizard, Adriano B. Lucatelli, Katharina Bart, Maya Bhandari, Jean Tirole, Hans Jakob Roth, Marco Martinelli, Thomas Sutter, Tom King, Werner Peyer, Thomas Kupfer, Peter Kurer, Arturo Bris, Frederic Papp, James Syme, Dennis Larsen, Bernd Kramer, Ralph Ebert, Armin Jans, Nicolas Roth, Hans Ulrich Jost, Patrick Hunger, Fabrizio Quirighetti, Claire Shaw, Peter Fanconi, Alex Wolf, Dan Steinbock, Patrick Scheurle, Sandro Occhilupo, Will Ballard, Nicholas Yeo, Claude-Alain Margelisch, Jean-François Hirschel, Jens Pongratz, Samuel Gerber, Philipp Weckherlin, Anne Richards, Antoni Trenchev, Benoit Barbereau, Pascal R. Bersier, Shaul Lifshitz, Klaus Breiner, Ana Botín, Martin Gilbert, Jesper Koll, Ingo Rauser, Carlo Capaul, Claude Baumann, Markus Winkler, Konrad Hummler, Thomas Steinemann, Christina Boeck, Guillaume Compeyron, Miro Zivkovic, Alexander F. Wagner, Eric Heymann, Christoph Sax, Felix Brem, Jochen Moebert, Jacques-Aurélien Marcireau, Ursula Finsterwald, Claudia Kraaz, Michel Longhini, Stefan Blum, Zsolt Kohalmi, Karin M. Klossek, Nicolas Ramelet, Søren Bjønness, Lamara von Albertini, Andreas Britt, Gilles Prince, Darren Willams, Salman Ahmed, Stephane Monier, and Peter van der Welle, Beat Wittmann, Ken Orchard, Christian Gast, Didier Saint-Georges, Jeffrey Bohn, Juergen Braunstein, Jeff Voegeli, Fiona Frick, Stefan Schneider, Matthias Hunn, Andreas Vetsch, Fabiana Fedeli, Marionna Wegenstein, Kim Fournais, Carole Millet, Ralph Ebert, Swetha Ramachandran, Brigitte Kaps, Thomas Stucki, Teodoro Cocca, Neil Shearing, Claude Baumann, Tom Naratil, Oliver Berger, Robert Sharps, Tobias Mueller, Florian Wicki, Jean Keller, Fabrizio Pagani, Niels Lan Doky, Karin M. Klossek, Ralph Ebert, Johnny El Hachem, Judith Basad, Katharina Bart, Thorsten Polleit, Beat Wittmann, Bernardo Brunschwiler, Peter Schmid, Karam Hinduja, Stuart Dunbar, Zsolt Kohalmi, Raphaël Surber, Santosh Brivio, Gérard Piasko, Mark Urquhart, Olivier Kessler, Bruno Capone, Peter Hody, Lars Jaeger, Andrew Isbester, Florin Baeriswyl, and Michael Bornhaeusser, Agnieszka Walorska, Thomas Mueller, Michael Welti, Ebrahim Attarzadeh, Marcel Hostettler, Hui Zhang, Michael Bornhaeusser, Reto Jauch, Angela Agostini, Guy de Blonay, and Tatjana Greil Castro.