Credit Suisse's Historic Legerdemain Over UBS

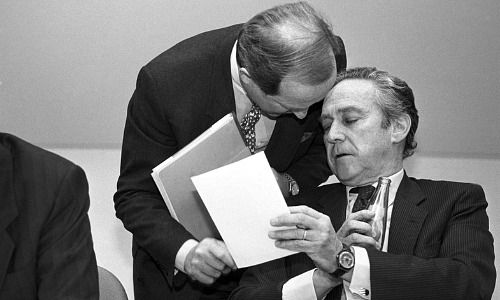

Unperturbed, Studer detailed his offer to Volksbank on January 5, including taking the smaller bank's brand off the market. Confident that Volksbank's CEO was his ally, Studer left Bern confident UBS had won the takeover battle.

«Poisoned Chalice»

As UBS' bankers put champagne to chill for the deal signing, they didn't know that Gut had put a better offer from Credit Suisse together, and presented it to the wider board. With Volksbank's directors irked that the rival offer had been kept under wraps in a committee until then, they turned their ire to Chairman Rueegg.

Ultimately, Volksbank voted 13 to 4 in favor of Credit Suisse's offer, a slap in the face for Rueegg, who continued to back the UBS offer. On January 5, he told both banks of the decision, but several UBS directors learned of Credit Suisse's successful raid in the evening news.

Rueegg stepped down one day later, when the deal was disclosed to the public in Credit Suisse's Zurich headquarters. In defeat, UBS voiced relief that it has escaped the «poisoned chalice» of Volksbank, referring to its troubled mortgage book.

UBS-Credit Suisse Tie-Up

After Volksbank posted a major loss for 1992, Credit Suisse cut hundreds of jobs at the bank and shut countless branches. Between April of 1993 and June 1995, Credit Suisse replaced nearly half of Volksbank's management. By the time Credit Suisse set up the group-wide structure in 1996 that it still uses today, Volksbank's brand name, by then heavily associated with boom and bust, had disappeared entirely.

The Volksbank deal proved to the first of a series of mergers between often-troubled lenders in Switzerland. The consolidation wave even saw Credit Suisse and UBS briefly talk merger, but the latter quickly opted out and chose Bank Corp. instead (click here for more).

- << Back

- Page 3 of 3