Rare Whisky or Cryptocurrency?

The Hong Kong based Whisky Investment Fund is making a case for tangible assets over their digital rivals.

The fund has reported that it closed on 30 June 2017, with commitments which exceeded its initial target of $10 million. It has capitalised on the dramatic sales growth of single malt whisky since its launch in June 2014, according to a recent statement.

It raised a total of $12 million in commitments from 50 private investors from around the world. Under a pilot of its exit strategy, the fund sold $1.5 million retail value of rare whisky in Hong Kong over the past year to private clients, luxury retail, auctions and F&B outlets such as hotels and fine whisky bars, at a net profit for investors of 65 percent.

Minuscule but Material

The numbers of course are tiny in comparison to the gigantic sums already invested into cryptocurrencies, but it is a tangible asset, you see it, touch it and «absorb» it, especially if other investments aren't performing as they should be.

The intangible aspect of digital currencies holds back many traditional investors as they like to see, touch or visit their asset.

Firms such as Singapore based TenX however are working hard to square that circle. With its in demand debit card linked to the leading cryptocurrencies, allowing users to spend their digital assets in the retail world TenX is bridging the gap between the virtual and the real worlds.

Alternative Asset

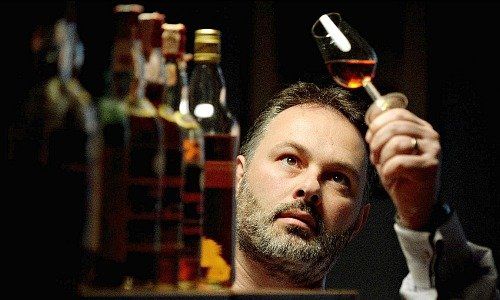

«Single malt whisky is not just a luxury good and a collector’s item, but also an investable alternative asset with good potential returns,» said Rickesh Kishnani, chief executive officer of Whisky Investment Fund.

To monetise its investment portfolios over the next four years, the Fund has signed a global and exclusive distribution agreement with Quintessentially, a luxury concierge service founded in London in 2000, now with 60 offices worldwide and many members who are whisky enthusiasts.

Balanced Approach

Rare Whisky 101 has been tracking every bottle of collectible whisky sold at a UK auction since 2008. The Rare Whisky Apex 1000 index, shows that rare whisky continues to significantly outperform other asset classes such as Gold and the FTSE 100, as well as others in the drinks industry such as fine wine (Liv-Ex Fine Wine 100) and Diageo (stock code DGE).

But that pales into insignificance when placed alongside the Crypto assets. Digital currencies have been soaring this year, with a total value of almost $149 billion, according to website for tracking capitalization of various cryptocurrencies «CoinMarketCap.»

Perhaps going forward a suite of investments made up of rare whisky along with Bitcoins might constitute the perfect balanced portfolio.