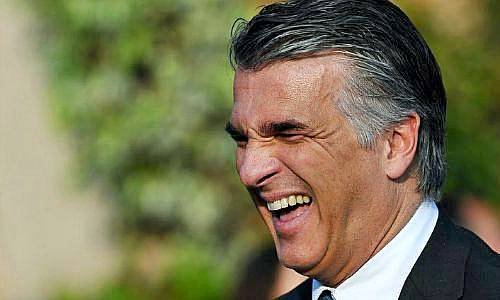

UBS chief executive Sergio Ermotti said the Swiss Bank has no plans to spinoff or list parts of its business, such as rival Credit Suisse is preparing to do for its «Swiss universal banking» by the end of next year.

Credit Suisse unveiled plans last October to list a minority stake in the unit, which includes part of its private banking and corporate and institutional clients business in Switzerland, as part of a contrary strategic plan that also includes job cuts, raising capital, and scaling back investment banking.

Sergio Ermotti denied any similar plans at UBS, marking another divergence in strategy between Switzerland's two large largest banks. «We believe our organization in terms of a holding company and operating company supporting divisionally and globally driven activities is important,» the CEO of UBS told a media briefing.

Ermotti sees a lot of value

«I believe that there is no intention on our side to pursue partial disposal of any business or legal entities, I think that there is a lot of value for our shareholders and for our model to keep things together in respect to helping the efficient management of our group,» Ermotti said.

Both banks have developed so-called Swiss entity banks separate from other, riskier operations, as a result of the too-big-to-fail requirements in Switzerland following the financial crisis and bailout of UBS in of 2008.

No to takeover of German bank

In response to a tongue-in-cheek question about whether UBS could takeover rival Deutsche Bank, where former SG Warburg and UBS banker John Cryan is restructuring the German lender, Ermotti said, «We do not need to think about a transformational deal, there is enough growth out there, we are extremely happy with our capital position and how our business is developing, but only through time can we really create value.» «The fundamentals of our business and the underlying growth of wealth management are extremely compelling.» he said.